PLANO, Texas, Jan. 15, 2024 (SEND2PRESS NEWSWIRE) — Today, Optimal Blue announced the release of its Originations Market Monitor report, looking at mortgage origination data through December month-end. Leveraging daily rate lock data from the Optimal Blue PPE – the industry’s most widely used product, pricing, and eligibility engine – the Originations Market Monitor provides a comprehensive and timely view into origination activity.

Image Caption: Originations Market Monitor report.

“Mortgage rates continued to fall in December, with the Fed delivering welcomed commentary suggesting rates may have peaked with cuts on the horizon in 2024,” said Brennan O’Connell, data solutions manager, Optimal Blue. “The sharp drop in rates provided tailwinds that caused rate/term refinance volume to rise a notable 43% month over month. Despite cash-out volume declining 9%, the total refinance share of locks rose to 19% in December – the highest level since April 2022. However, the improving rate environment had little impact on purchase lending, where lock volume fell 23% in December, traditionally the slowest month for homebuyer activity.”

The growth in rate/term volume was largely driven by a material uptick in VA Interest Rate Reduction Refinance Loans (IRRRLs). IRRRL volume hit its highest level since January 2022, and the total refinance share of VA volume rose to nearly 30%. As a result, VA volume saw the highest market share gain in December, rising 137 bps to finish the month at 11.8% of total volume. FHA refinance volume also ticked up in December, despite FHA total volume dropping 105 bps of market share to 21.5% of total volume. The GSE-eligible share rose 36 bps to 56.6% and nonconforming volume – inclusive of jumbo and non-QM – dropped 72 bps to 9.4%. The adjustable-rate mortgage (ARM) share of locks continued to fall, dropping to 5.2% of total volume, indicating further fading of consumer interest in the product.

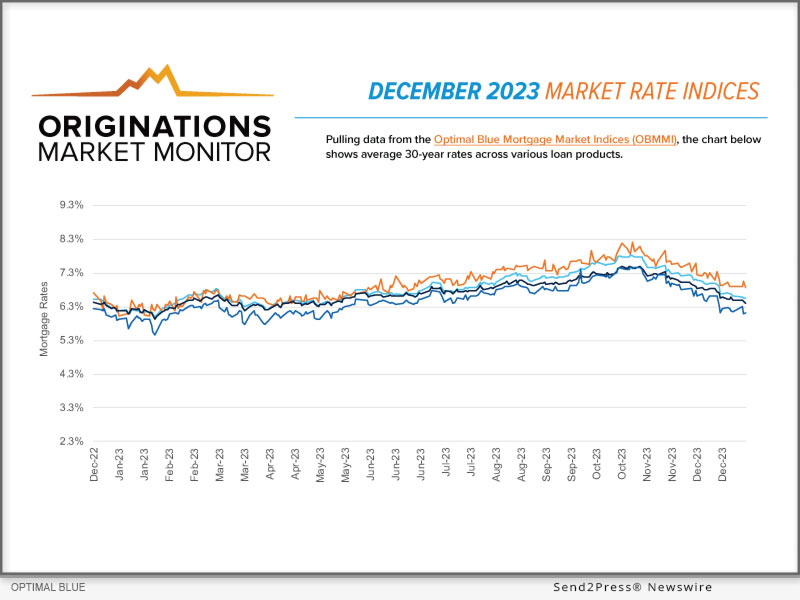

The Optimal Blue Mortgage Market Indices (OBMMI) 30-year conforming rate dropped 54 bps to finish the month at 6.57%. The OBMMI for jumbo, FHA, and VA loans fell 74 bps, 49 bps, and 67 bps, respectively.

“The spread between the 30-year conforming rate and the 10-year Treasury yield remained essentially flat in December as government bonds and mortgages benefitted equally from the positive fixed-income outlook,” O’Connell continued. “Looking ahead to 2024, the mortgage-to-Treasury spread remains elevated from historic norms at roughly 275 bps, suggesting there may be further room for compression and reduction in mortgage rates.”

The rise in rate/term refinance volume coincided with a drop of 8 points in the average credit score as borrowers with lower credit scores jumped on the opportunity to lower their monthly payments with VA and FHA refinances. Purchase and cash-out refinance credit scores ticked higher, however. The average loan amount rose to $349.5K from $347.4K, while the average purchase price saw another – albeit smaller – decline, falling from $438.3K to $435.9K.

Each month’s Originations Market Monitor provides high-level origination metrics for the U.S. and the top 20 MSAs by share of total origination volume. View the Optimal Blue Originations Market Monitor report for more detail on December activity.

Nothing herein shall be construed as, nor is Optimal Blue providing, any legal, trading, hedging, or financial advice.

About Optimal Blue

Optimal Blue is the market leader in mortgage secondary marketing technology. The company facilitates transactions among mortgage market participants through its Marketplace Platform, actionable data, and technology vendor connections. The platform supports a range of functions for originators and investors to automate and optimize core processes related to product, pricing, and eligibility, hedge analytics, MSR valuation, loan trading, social media compliance, and counterparty oversight. The company’s premier product, pricing and eligibility engine – the Optimal Blue PPE – is used by 64% of the top 500 mortgage lenders in the U.S.

For more information on Optimal Blue’s end-to-end secondary marketing automation, visit http://OptimalBlue.com/.

MULTIMEDIA:

Image link for media: https://www.Send2Press.com/300dpi/24-0115-s2p-opbluereport-300dpi.jpg

Image caption: Originations Market Monitor report.

RELATED LINKS:

https://www2.optimalblue.com/wp-content/uploads/2024/01/OB_OMM_DEC2023_Report.pdf

X/Twitter: @OptimalBlue #Mortgage #OriginationsMarketMonitor #SecondaryMarkets #HousingFinance #MBS

News Source: Optimal Blue

To view the original post, visit: https://www.send2press.com/wire/optimal-blue-originations-market-monitor-december-brought-significant-growth-in-rate-term-refinance-volume-as-falling-rates-created-favorable-tailwinds/.

This press release was issued by Send2Press® Newswire on behalf of the news source, who is solely responsible for its accuracy. www.send2press.com.